Introduction

The recent Frankfurt Motor Show in September 2917 saw major car companies exhibited several models of electric cars. Subsequently, investors are piling-up their bets on mining companies that are involved in lithium, the key component for making batteries for electric cars. BlackRock, one of the largest fund managers in the world, has emerged as a investor of lithium start-ups.

The BlackRock World Mining Trust, which has more than £800 million in assets and is co-managed by Evy Hambro, has become the largest shareholder in a handful of small mining companies aiming to produce lithium for use in batteries.

Demand for lithium has surged as the first mass market electric vehicles (EVs) such as the Tesla Model 3, Nissan Leaf and Chevrolet attract buyers. Growing demand for EVs has sparked a scramble to locate new supplies of lithium and prices have jumped about 26 per cent this year, making it one of the best performing commodities this year.

“Today the energy space is evolving towards a low carbon footprint and the combustion engine is going to be replaced with an alternative, “ Mr. Hambro said. “We want to be invested in companies that will be producing the raw materials that will be needed to meet this growth.”

Mr. Hambro is one of the world’s most influential mining investors, and his views are closely followed by the industry.

BlacRock’s investment parallels a growing investor interest in lithium as regulators push a transition to electric cars and battery costs continue to delcine. For example, assets in the Global X Lithium & Battery Tech exchange traded fund have quadrupled during this year from US$114 million to $484 million, while the Solactive Global Lithium index, made up of 26 miners and battery makers, had delivered a total return of 51 per cent this year.

Lithium production is currently dominated by four large firms, Chile’s SQM, FMC, Albermarle and Tianqi Lithium. A number of smaller companies are racing to bring supply to market and get their materials approved for use in batteries.

Over the past year around US$1.0 billion has been raised by lithium developers and explorers, but the funding will need to be increased to US$6.0 billion in 2025 to meet demand, according to Simon Moors of Benchmark Mineral Intelligence in London, which tracks lithium prices.

A Boon for Sensor Makers

Lithium producers are not only enjoying from electric car revolution. Sensor makers are also experiencing a boon. As electric cars become a reality, carmakers and their suppliers are confronting challenges that appeared less tangible when the dream of electric cars was a more distant vision.

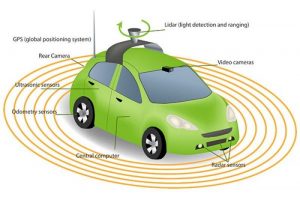

A self-driving car of the future will be quipped with at least 20 sensors using cameras, radar and lidar to “see” its surroundings.

Some of the data must be transmitted to the “cloud” so the car cam communicate with its surrounding, but programming the software to send only the relevant data is a central challenge, says Elmar Degenhart, chief executive of the parts supplier Continental.

He says a self-driving car collects raw data at a rate of up to 15 gigabytes per second. By comparison, a person watching Netflix in high definition at home would consume three gigabytes of data per hour. “We need a different kind of electronic architecture to handle these volumes of gigabytes, “ he says.

The energy just required to power these self-driving systems is so great that a prototype electric car with a 400 km range can drive only 200 km autonomously, notes Scott Gallett, vice-president of marketing for BorgWarner, a maker of propulsion systems.

“One of the things people don’t talk about is just how much energy is really required by by the computers, the sensors, the radars, “he says. “Some of the prototypes out right now require just as much as energy as it does to propel the vehicle.”

Mr. Gallett believes that hybrid vehicles—often considered as a stop-gap measure to full electric cars— will experience a lengthier phase than many assume, because if autonomous technologies become popular then cars driven solely by batteries might not have enough energy to power bith the car and the computing system.

“Don’t think autonomous equals elecytric,” he adds.

Reference: FTWeekend 16 September/17 September 2017